Top SMSF Auditing Mistakes to Avoid at All Costs

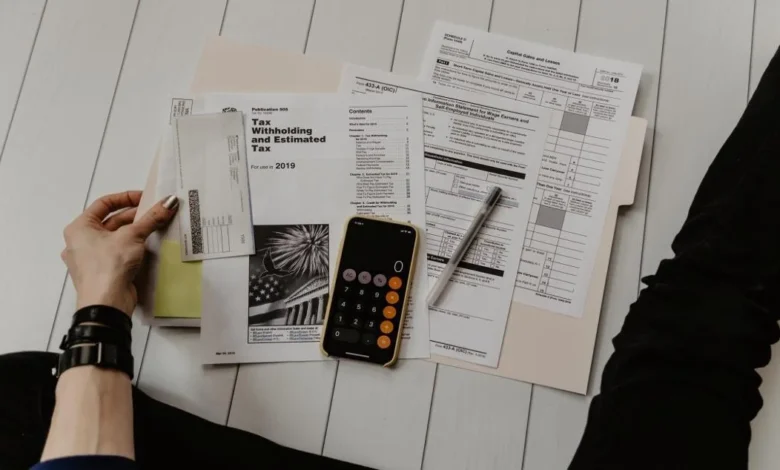

Self-Managed Superannuation Funds (SMSFs) have become famous for individuals seeking greater control and flexibility over their retirement savings. However, managing an SMSF comes with responsibilities, including the crucial task of auditing. SMSF audits ensure compliance with regulatory requirements and safeguard the financial integrity of the fund.

To navigate this process successfully, it’s essential to be aware of the common mistakes regarding SMSF auditing in Australia and take proactive steps to avoid them.

Inadequate Record Keeping

Inadequate documentation can lead to compliance issues during audits. Ensure that all financial transactions, statements, and supporting documents are accurately recorded and retained. Regularly review and update records to reflect the current state of the fund.

Failure to Separate Personal and SMSF Assets

A fundamental requirement for SMSFs is maintaining a clear separation between personal and fund assets. Mixing personal and SMSF finances can lead to confusion, compliance breaches, and potential legal consequences. Establish a distinct bank account for the SMSF and refrain from using fund assets for personal expenses.

Inaccurate Valuation of Assets

Properly valuing SMSF assets is critical for compliance and financial reporting. Common mistakes include overestimating or underestimating the value of assets. Regularly assess and update asset valuations based on market conditions to ensure accurate reporting and regulation compliance.

Delayed Lodgment of Annual Returns

Failure to submit annual returns on time is a severe compliance breach. Late lodgments can result in penalties and may attract the attention of regulatory authorities. Establish a systematic approach to meet reporting deadlines and consider seeking professional assistance to ensure timely lodgment.

Inadequate Investment Diversification

SMSF trustees are responsible for making sound investment decisions that align with the fund’s investment strategy. Failing to diversify investments appropriately exposes the fund to unnecessary risks. Regularly review the investment strategy, consider professional advice, and ensure that investments align with the fund’s objectives.

If you are looking for a trusted audit and assurance firm to help manage your SMSFs, then DFK Laurence Varnay is for you. We give our clients expert advice and strategic solutions that can help improve business performance in the long run. Visit www.dfklv.com.au/contact if you have any questions about our services.